|

At Mortgage Architects, we recognize that many homeowners may be looking for guidance around mortgage financing. We are committed to updating you - our customers - on the current climate and how the recent COVID-19 developments may impact your mortgage, now or in the future. We know that things may seem uncertain now, but we are working hard to gather all pertinent information and help you to understand your options during this difficult time. Please check back regularly to get additional and updated information as more details arise. What is COVID-19? As many of you have heard by now, the world is being gripped by COVID-19 (otherwise known as “Coronavirus”). According to the World Health Organization (W.H.O.), Coronaviruses (CoV) is a large family of viruses ranging from the common cold to more severe diseases. Coronavirus disease (COVID-19) is a new strain that was discovered in 2019 and has not been previously identified in humans. Common signs of infection include respiratory symptoms, fever, cough, shortness of breath and breathing difficulties. In more severe cases, infection can cause pneumonia, severe acute respiratory syndrome, kidney failure and even death. Standard recommendations to prevent infection spread include regular hand washing, covering mouth and nose when coughing and sneezing, thoroughly cooking meat and eggs. Avoid close contact with anyone showing symptoms of respiratory illness such as coughing and sneezing. Financial Effects Since being labelled a pandemic per the World Health Organization (W.H.O.), the effects of COVID-19 have begun to ripple through the world’s economy - including Canada - and causing a number of different effects. To help keep you up to date on what is going on financially, we have compiled a list of recent announcements by the Ministry of Finance, the Bank of Canada, and OSFI:

Homeowner Need to Know This can be a difficult time for a homeowner as many families are self-isolating or are in quarantine due to the virus. This can result in loss of monthly income and financial instability, which can cause stress and concern about your home and mortgage. We have compiled the following information from our partners to keep you informed as to some of the recent developments surrounding mortgages, as well as what lenders are doing to help mitigate financial strain during this difficult time. Here are a few important considerations for homeowners and potential homeowners to keep in mind during this time:

The Stress Test In light of this growing situation, OSFI has announced that it is suspending all consultations, including those regarding changes to the proposed B-20 benchmark rate. In addition, the Minister of Finance postponed the announced April 6th qualification change for insured mortgages. In short, until further notice, the Bank of Canada posted 5-year rate will continue to be used for mortgage qualification. What Lenders are Doing We understand that the COVID-19 outbreak is taking a toll on families across the country with many parents being out of work or quarantined. As an industry built on homeowners, many of our major lenders have pulled together to provide you beneficial options during this time and help alleviate some of the financial stress. Depending on your lender, there may be options available to you during this time such as:

The Big Banks Big banks including Royal Bank of Canada (RBC), Toronto-Dominion Bank (TD), Bank of Nova Scotia (Scotiabank), Bank of Montreal (BMO), Canadian Imperial Bank of Commerce (CIBC) and National Bank of Canada have opted to provide coordinated relief for their customers. These banks will be working with personal and small business clients to cope with the economic fallout of the virus. Effective immediately, all six are introducing mortgage payment deferrals of up to six (6) months and are also offering relief on other credit products for those families who are facing hardship during this situation. Mortgage Insurers In addition to the big banks, mortgage insurers including CMHC, Genworth & Canada Guaranty are working to help homeowners who have been financially impacted by the COVID-19 outbreak. Starting now, they have increased their flexibility and are allowing payment deferral of up to 6 months for home-owners who, primarily but not exclusively, purchased with less than 20% down. CMHC also provides mortgage professionals with tools and the flexibility to make timely decisions when working with you to find a solution to your unique financial situation, including:

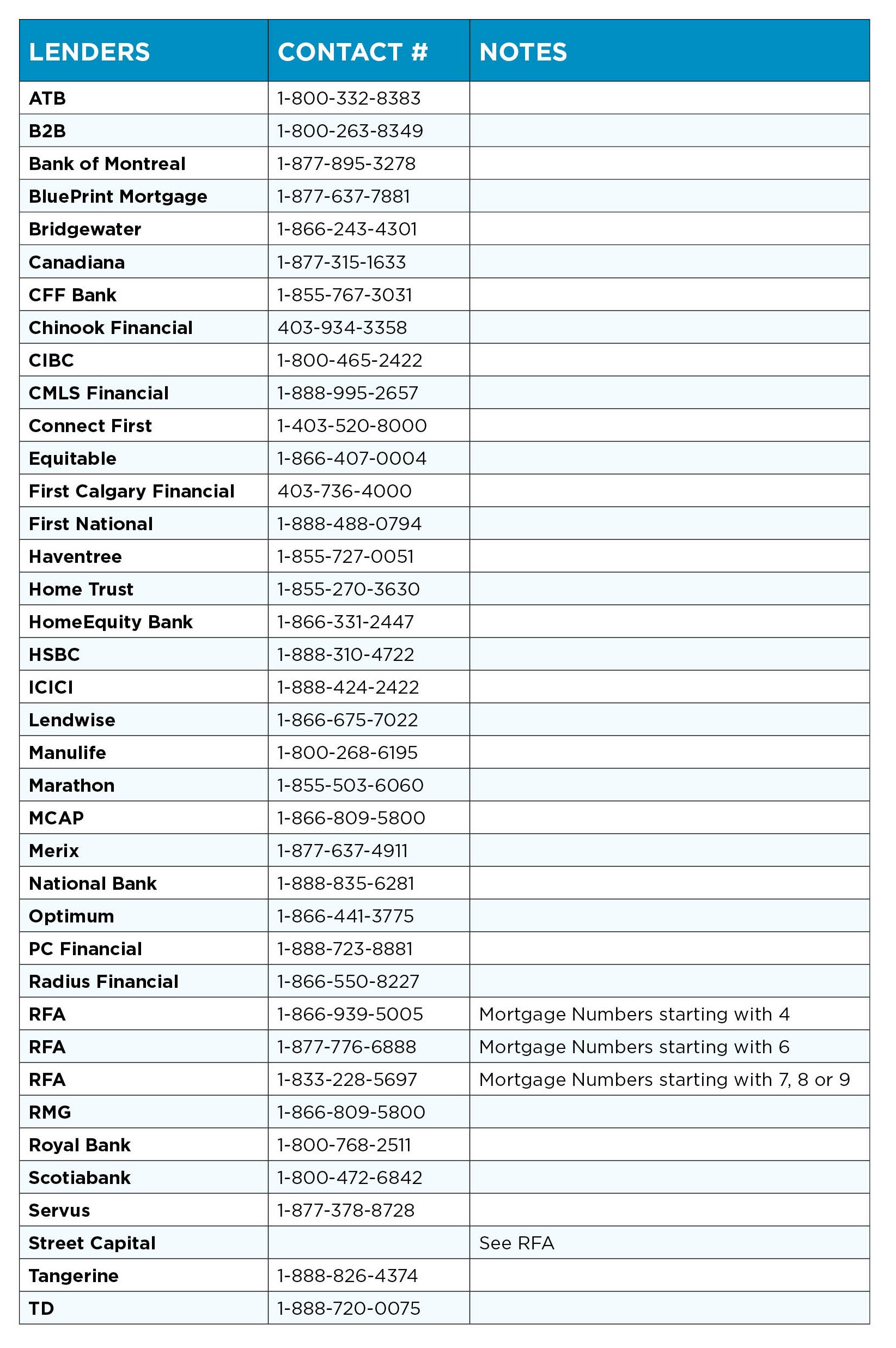

Canada Guaranty In addition to Genworth Canada and CMHC, Canada Guaranty is also doing their part to support homeowners during this difficult time. Per their statement released on March 16, 2020 they noted with their Homeownership Solutions Program, lenders currently have the ability to capitalize up to four (4) monthly mortgage payments. However, to assist eligible homeowners as they navigate through these challenging circumstances, Canada Guaranty is prepared to extend this program option to allow the capitalization of up to a maximum of six (6) monthly payments. This is assuming the original insured loan amount is not exceeded, request for capitalization is received before September 13, 2020 and that the lender confirms the capitalization is being applied reasonably to help mitigate short-term financial difficulty resulting from COVID-19. Lender Contact Information During this time, it is best to discuss your mortgage with your mortgage broker or lender should you have any financial concerns surrounding the COVID-19 outbreak. Please be advised, there may be longer than normal wait times for calls during this situation and to expect at least 20-30 minutes for a representative. Be sure to have your mortgage number available to ensure smoother service and remember to be kind! Here are some direct contact numbers for various lenders across the country:

Emergency Funds During COVID-19

What Can You Do? If you find yourself facing financial difficulties as a result of job loss or income reduction during this time, it can be overwhelming and may leave you feeling stressed and unsure of what the next steps are. To make it easy, we have put together three simple steps you can do to help resolve your financial difficulties and ensure you can focus on more important things such as your family and your health. 1. Cut Down on Costs For anyone that is currently out of work due to COVID-19 or has found themselves at reduced hours, it is a good idea to look at your finances for ways to cut down on non-essential costs. Some ideas for reducing your monthly expenses include taking a look at streaming services, your phone data plan and gym memberships which can add up. 2. Talk to Your Mortgage Professional Your Mortgage Architects mortgage brokers are working hard to stay on top of all information surrounding the development of COVID-19 as well as the responses from Bank of Canada and the Ministry of Finance to ensure the most up-to-date and accurate information to assist you. They can help explain the options available to you and provide further understanding as to how this situation may affect your interest rates and mortgage payments. 3. Contact Your Credit Card Companies and Lenders Many families and individuals cannot afford to lose their income, or even see it decrease. If you are in debt or living paycheck to paycheck, you may already find it difficult to make bill payments. Unfortunately, missing these payments can have long-term negative effects. Before it gets to this point, it is a good idea to contact your lenders, banks or credit card companies to see if there are options. 4. Find alternatives Whether you are temporarily laid off, let go of your company or do not have enough sick days to cover your time at home.

5. Stay Informed Information is power and the more information you have at your disposal as this situation develops, the better prepared you will be to manage your household and finances. We will be providing updated information right here on our website as this situation develops. Additional Support We understand that along with financial hardships, many individuals are also experiencing a drastic toll on their mental health with regard to COVID-19. For any individuals that are currently managing mental health disorders (anxiety, depression, bi-polar disorder, etc), please be sure to check with your mental health professional during this time if you are experiencing an increase in your symptoms. In addition to your regular care, the Canadian Mental Health Association is working hard to continuously update their website with resources related to pressures, anxiety and other stressors in the midst of this pandemic. For more information, please visit their website here. They also have a 24/7, toll-free crisis line at 1-833-456-4566. Some other programs that may assist you and help reduce the mental and emotional burdan of this situation can be found below. Employee Assistance Program (EAP): This dedicated program is providing the following:

Click here to visit their website and learn more. First Access: This program provides global support for unique needs and for organizations who are not EAP clients. Some of the features they offer are:

Click here to visit their website and learn more. Stay Safe - and Wash Your Hands! Remember during this time to practice proper hand-washing procedures and minimize your contact with other people to ensure that you are not unknowingly contracting or passing along COVID-19. We can overcome this, together!

RELATED LINKS

5 Smart tips about closing costs Congratulations! You're a home owner. Your offer has been accepted and your home is closing soon...Now what? ...more

To buy or not to buy? If you can afford to rent, chances are that you can afford to buy. Start building equity for your future by putting your monthly rent toward a monthly mortgage payment! ...more |

|

Considering a fixed rate mortgage? Get informed!

Considering a fixed rate mortgage? Get informed! Renovating your home is within financial reach. Find out how!

Renovating your home is within financial reach. Find out how! Is your mortgage coming up for renewal? You should talk to a broker!

Is your mortgage coming up for renewal? You should talk to a broker!

Want a mortgage? Get a mortgage! Apply now!

Want a mortgage? Get a mortgage! Apply now!

Want to find your monthly payment or what you can afford? Find out this and more with our easy to use calculators!

Want to find your monthly payment or what you can afford? Find out this and more with our easy to use calculators!